The average cost of therapy in America for each state

Published March 9, 2025

If you’re a therapist or private practitioner who is feeling overwhelmed at the idea of sorting through all your receipts and doing your taxes this tax season, you’re not alone.

I work with many private practice owners who feel the same way. And, while I can’t turn back the clock to give you more time to file, I can help make the filing process for your business a little easier.

Here are the six things I wish all private practice owners knew about doing their taxes:

Tax forms and deadlines seem like simple concepts, but they’re a critical first step when you’re starting your taxes—and it’s easier than you think to make a mistake. First, let’s walk through how to make sure you’re using the right tax forms.

When you started your business, you most likely applied for an EIN and received it in a letter from the IRS. That letter will tell you exactly what form the IRS is expecting. Make sure that’s what you are filing.

If you’re not sure where you stashed that letter with all that information, here’s a general guide.

If you still have questions about tax forms and deadlines as they apply to your practice, reach out to your accountant to make sure you’re doing it correctly.

Also, don’t forget that the cost of SimplePractice EHR software for therapists is fully tax deductible.

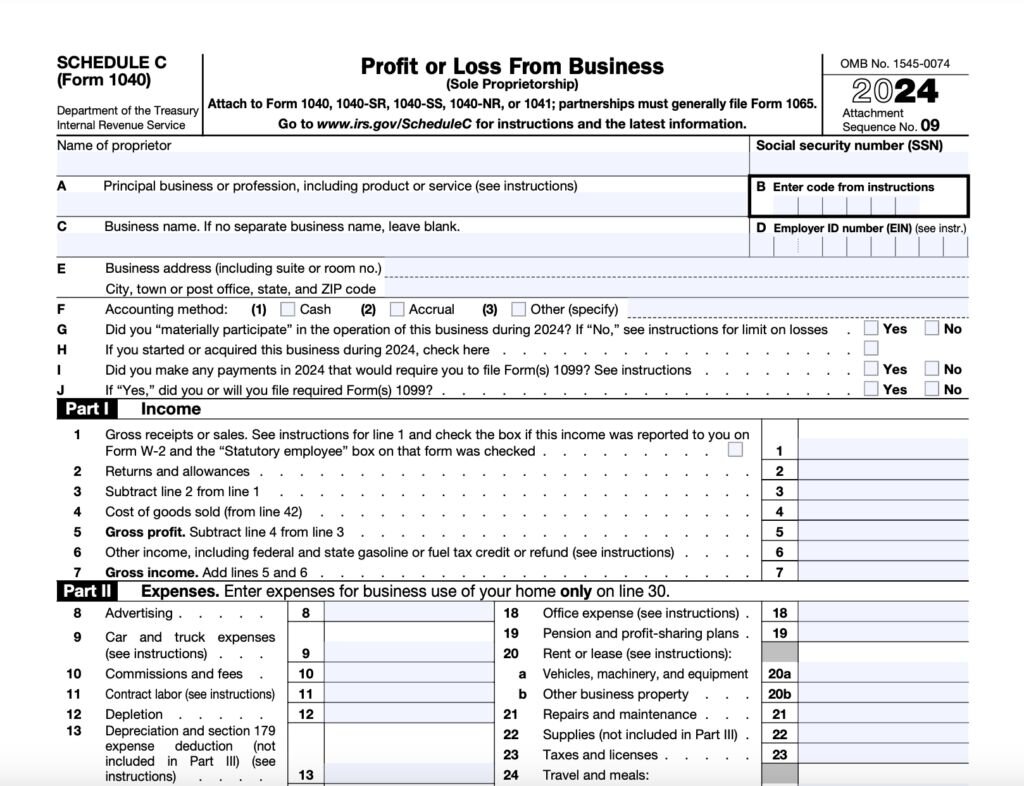

You may enter the SimplePractice EHR as 27a “Other Expenses” on form 1040 Schedule C.

Then, in Part V, under “Other Expenses,” create your own description and enter the amount and total on line 48.

2. A filing extension does not equal an extension to pay

2. A filing extension does not equal an extension to pay

A six-month tax extension is available for both businesses and individuals. However, I’ve found the word “extension” can be somewhat misleading.

While an extension gives you additional time to file your taxes, it does not change the due date of your tax payment.

See what I mean? Confusing.

When you file an extension, you still need to estimate your tax liability and pay any amount that’s due. So if you haven’t made quarterly estimated payments throughout the year, and you’re not making a payment with your extension, prepare to have interest and penalties assessed.

There may be tax deductions for therapists and private practitioners that you overlooked.

Maybe you didn’t even know they existed.

Some examples of deductions that are often overlooked include continuing education courses, the licensing process, and home office furnishings and improvements.

These are only some examples of possible tax deductions you can take.

Make sure you check this list and also consider checking with an accountant so you can maximize all deductions that apply to your practice. I think we can all agree that there’s no reason to pay more when tax season comes around than absolutely necessary.

At the risk of sounding like your parents, I’m going to ask you a question. Have you been saving for taxes every month?

Can you confidently and effortlessly pay taxes when the time comes?

Tax season will feel a lot less stressful if you know you can pay what you owe.

Most business entities (except C-corporations) don’t pay taxes at the federal level, although some states do have a business tax.

So, how does a small business get taxed? The profit flows through to your personal tax return. This means you, as a business owner, will get taxed on the business profit whether you take the cash out of the business or not.

Depending on the legal entity of your business, some or most of the money you pay yourself hasn’t been taxed yet.

If you’re a few years into running your private practice, you likely pay quarterly estimated taxes.

If it’s your first year in business, you may not have paid Uncle Sam yet, and you might be facing a pretty large tax bill.

Either way, you should be saving money each month to pay for that inevitable tax bill.

In fact, the most common mistakes I see first-year owners of private practices make is not saving enough money (or not saving at all) for taxes.

If you don’t know how much to save each month, reach out to your accountant and create a plan now for next year.

Set up a separate bank account for your business. Most business-related expenses are deductible, but you have to track all of your transactions and keep all of the receipts.

One of the number one reasons owners of private practices don’t file their tax returns on time is because their financial records are a mess, or worse—they’re nonexistent.

Tracking your expenses on a monthly basis in your business account’s bank statements will make tax season so much easier. Plus, it will also give you valuable information about your business throughout the year.

Tax mistakes can cost you. Ironically, the main reason many small business and private practice owners do their own taxes is to save money.

Alas, tax mistakes can be much more expensive than simply getting professional help from an accountant in the first place.

There’s no shame in getting the financial support you need—especially if it saves you money and valuable time in the long run.

At least a few times each year, I see some pretty significant mistakes on self-prepared tax returns.

And I’ve first-hand seen how stressful it can be for private practice owners to get letters from the IRS or state tax authority.

If you love the numbers and feel confident doing your own taxes, then by all means, keep at it.

But, if just the thought of taxes stresses you out, save yourself some time (and most likely some money) by getting the support you need for taxes and other financial concerns.

Disclaimer: This article shouldn’t be regarded as financial advice. We recommend you meet with an accountant or tax professional to help you make these decisions.

SimplePractice is HIPAA-compliant practice management software with booking, billing, and everything you need built into the platform.

If you’ve been considering switching to an EHR system, SimplePractice empowers you to run a fully paperless practice—so you get more time for the things that matter most to you.

Try SimplePractice free for 30 days. No credit card required.

READ NEXT: Tax deductions for therapists and private practitioners

Julie Herres is an accountant and the founder and CEO of GreenOak Accounting, a firm that specializes in working with therapists, psychologists, and counselors in private practice.

Proudly made in Santa Monica, CA © 2025 SimplePractice, LLC

Proudly made in Santa Monica, CA © 2025

SimplePractice, LLC