Tips for Bookkeeping for Group Private Practices

Download the free bookkeeping checklist for group practices

Download free resource

Enter your email below to access this resource.

By entering your email address, you are opting-in to receive emails from SimplePractice on its various products, solutions, and/or offerings. Unsubscribe anytime.

As a group practice owner, you may wear two different hats: clinician and entrepreneur.

Among the tasks required of you as an entrepreneur, bookkeeping for group private practices is one you may not be as interested to take on. After all, bookkeeping for therapists doesn’t make it into the core curriculum of the training you completed to become a mental health clinician.

That said, the harsh reality is that every small business needs cash to survive—and in a group practice, money and cash flow are even more critical to stay on top of.

You might not be thinking about the monthly budget for your practice when you’re wearing your clinician hat, however it’s important to dedicate a few hours each week when you are wearing your business owner hat to keeping track of your finances.

Bookkeeping for therapists should be part of a comprehensive financial plan to keep your business healthy and sustainable—especially if you’re responsible for bookkeeping for group private practices.

According to CBInsights, 38% of businesses that fail, do so because they simply run out of cash. With that in mind, we have some simple steps you can take to manage your group practice’s accounting and bookkeeping.

Basics of bookkeeping for therapists

Bookkeeping is the recording and organizing of financial transactions within a business. It involves maintaining accurate records of all income, expenses, assets, liabilities, and equity.

The purpose of bookkeeping for therapists is to have a clear overview of the financial health of your business, so that you, the business owner, can make informed data-driven decisions.

The true magic in bookkeeping isn’t simply getting accurate accounting of where the money goes each month—it provides incredibly important insights into the overall health of your business. If you don’t know what’s going on under the hood, you won’t be able to accurately answer essential questions like: Can I afford this office space for the entire year lease? Should I raise my therapy rates? Am I saving enough money for taxes?

Your Profit and Loss, Balance Sheet, and Statement of Cash Flows will hold the answers to these questions.

How is bookkeeping for group private practices different from solo practices?

The larger a therapy group practice, the higher the volume of transactions. As a practice grows, so will the cash flow variations.

One of the factors that further complicates bookkeeping for group practices is payroll. When you have additional team members in your practice (whether they are contractors or employees), there can also be interpersonal conflicts and employee issues to deal with, as well.

When you’re busy managing a team, you’ll have less time for clerical tasks like billing and bookkeeping, so these are often among the first tasks to be outsourced.

In solo practices, the owner will often need to be a jack-of-all trades. You may have your hand in everything out of necessity.

It can be helpful to learn the basics of bookkeeping for therapists so that you can do some (or all) of the work on your own. This will allow you to keep more of your hard-earned money.

Even if you’re managing and updating your books yourself throughout the year, you may want to work with a professional tax accountant at the end of the year. This is because accounting for private practice therapists is complex and you don’t know what you don’t know, so there is a good chance there could be mistakes in your bookkeeping.

If you have a good tax accountant who can look over your shoulder and correct any mistakes at the end of the year, there’s a better chance your tax return will be accurate.

Managing your bookkeeping in group practice

You may have a bookkeeper handling bookkeeping (and possibly payroll) behind the scenes, but you’ll always need to keep an eye on your financial reports, payroll, and cash flow.

When it comes to bookkeeping for group private practices, payroll will typically be your single largest expense. Making intentional, data-driven decisions on team compensation will not only set your group practice up for financial success, but will also pay dividends for years to come.

Ideally, you’ll offer a compensation package that is attractive to potential team members and sustainable for your group practice. It’s a good idea to leave some wiggle room for benefits or raises you’d like to add down the line.

In general, fully-licensed clinicians should take home no more than 45% to 60% of the revenue they generate for the practice, including wages, payroll tax, and benefits.

Interns, residents, and pre-licensed clinicians will typically make less.

Keep in mind that your state regulations may very well add to the cost of having employees.

Regulations vary widely from state to state, but some things to keep an eye on are regulations around time keeping, mandatory paid time off, or sick leave, as well as paid family leave and other requirements.

When cash flow feels really tight in a group practice, payroll is quite often the culprit. Be sure you are familiar with the three most common group practice payroll models.

If you’re not sure how much you should be spending at each stage of private practice, this free KPI tracker may help.

Habits that financially successful practice owners share

These tips can help you master bookkeeping for group private practices.

Keep your business and personal finances separate

Without co-mingling, you’ll have clarity on how much money your practice is generating.

Save for taxes regularly

When you work with a professional tax accountant throughout the year or at year-end, you’ll receive quarterly estimated tax vouchers to pay your current year’s tax liability.

Make a plan to pay the amount on the vouchers, and if your business income has increased significantly, talk to your accountant about saving even more for taxes.

More income means more taxes. It’s not the worst problem to have, so long as you ensure you’re covered when tax time comes around.

Take time to review financial reports, at least once a month

This process will help you learn what’s normal and what isn’t in your practice. With that knowledge, you’ll be able to identify issues faster.

You’ll get a chance to identify if the changes are what you expected and answer questions such as:

- Is income lower than you thought it would be? If so, why?

- Did income increase but profit did not? What happened?

Looking at the numbers will help you find the answer.

Surround yourself with professionals

As you move into group practice, one of the important transitions to make is to surround yourself with professionals who can support your practice. Some examples include a bookkeeper, biller, chief financial officer (CFO), human resources (HR) consultant, attorney, marketing consultant, a business coach, etc.

Each of these professionals is knowledgeable about their specific area of expertise, and they are also likely to be more efficient at their tasks.

If you’re spending hours managing claim denials, an experienced biller can probably get to a resolution much faster than you can, and save you lots of frustration.

How to find the right accounting professional for you

It’s important to find the right professionals for your group practice therapy business. Each professional will have their own unique style, and it’s important that you decide what kind of expertise and workflow is best for your group practice.

Do you want to communicate primarily via email or phone? Would you like to learn from the bookkeeping professional you hire, or would you like to completely outsource all billing and accounting?

Not every professional will be right for you. It’s OK to decide what your needs are, and if someone isn’t meeting them, then find someone that will.

Just because one relationship with a marketing consultant failed, doesn’t mean that you should never work with a marketer again—you just need to find the one that’s right for you.

Bookkeeping for group private practices isn’t just a task—it’s a crucial part of effectively managing your practice. Having accurate financial records will help you be a better business owner, no matter what stage of private practice you are in.

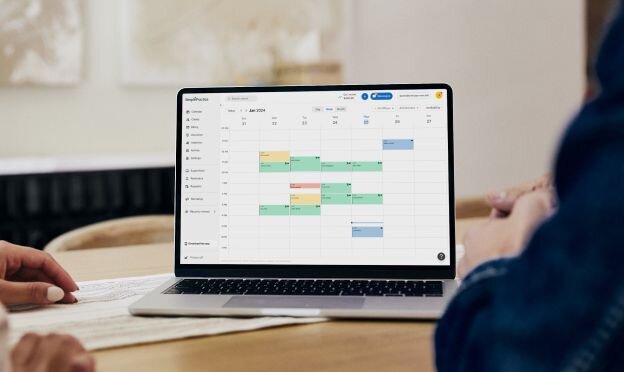

How SimplePractice helps you confidently manage your group practice

SimplePractice is an all in one practice management software that helps you confidently manage a group practice and handle everything from insurance billing and client work to team management and business operations.

Streamline insurance billing with easy-to-use tools that enable you and your clinicians to create, submit and manage batches of claims all within SimplePractice. Or, opt to let professionals handle insurance billing on your behalf, from claim submission to claim resolution.

Plus, your group practice clinicians benefit from integrated client care and management tools. Clinicians can automatically send and analyze client measures like the PHQ-9 and GAD-7, while keeping track of client outcomes over time, and seamlessly manage client engagement from one Client Portal.

Try SimplePractice free for 30 days. No credit card needed.