Getting Started with Insurance Billing for Private Practice OTs

Download the free insurance billing for OTs eBook

Download free resource

Enter your email below to access this resource.

By entering your email address, you are opting-in to receive emails from SimplePractice on its various products, solutions, and/or offerings. Unsubscribe anytime.

Getting started with insurance billing can seem overwhelming, but it’s also a great way to grow your potential client base. In this eBook, we walk through the basics of insurance for occupational therapists.

When you join an insurance panel for the first time, you’ll go through a process called credentialing. It is during this process that your contracted rate is determined.

A contracted rate—also known as a negotiated rate, an allowed amount, or an agreed upon amount—refers to the amount an insurance payer agrees to reimburse for your services.

To become an in-network provider for an insurance company, you must first apply online by visiting the insurance company’s website. After you apply, it’s important that you fill out a Council for Affordable Quality Healthcare (CAQH) Pro View Application. The CAQH is where you will self-report your education, training, and experience. It may seem like a long and tedious application, but unless your information changes, you will only have to update your service area, contact information, business hours, services you offer, insurance accepted, and information about you, so people can find you online.

All insurance companies will use this application to verify your qualifications. This entire process is slow, and persistent follow-up is key. It is important to document every interaction that you have with the insurance company, specifically the insurance representative’s name that you spoke with and a reference number for the call. Be diligent and follow up at least twice a month.

If you’re not sure which insurance companies will be the most valuable for you to partner with, think about the population you are most interested in servicing and consider the dominant employers in your area.

Do some research online or reach out to a colleague to find out what insurance they offer their employees. If a large percentage of your surrounding area is insured through Medicare or Medicaid, consider joining those panels. We also recommend researching which insurance payers have the most competitive reimbursement rates in your area.

One mistake new providers make is enrolling in too many panels right from the start. We recommend starting out on the panel of only one or two insurance companies so you can have an idea of how much time and work you will need to commit to insurance billing.

Some questions to consider when joining an insurance panel are how quickly do you want your practice to grow? Can you attract patients on your own? Is the panel you’re considering open to new providers?

Once you make the decision about which panels to join, you need to verify your client’s benefits. When you verify a client’s insurance policy, you may find that a prior authorization is required. Insurance companies will often request a referral from your client’s primary care physician, current diagnosis, planned treatment services, and medical information about your client to determine medical necessity.

Prior authorizations can vary per insurance company and health plan. Some payers allow you to submit a request for an authorization online or by fax. For first time authorizations, we recommend calling. If you call an insurance company to discuss a pre-authorization make sure to note the time, date, the representative that you spoke with, and a reference number.

When it comes to billing and coding basics, it’s important to understand the difference between CPT and ICD-10 codes. ICD-10 codes, International Classification of Diseases, are used to diagnose a patient’s condition. You must have the proper documentation to support this diagnosis. You will need to know who the diagnosing physician was that gave the order for your client to receive the services that you provide. Documentation requirements vary by payer, but Medicare outpatient therapy guidelines are the criteria used by most payers for occupational therapy services.

ICD codes are updated every October. This means that codes can be added, revised, or deleted. It is essential to stay up-to-date yearly with these changing codes so that you don’t find yourself using codes that are no longer accepted by insurance companies. If you accidentally bill an ICD-10 code that is no longer active, your claim will be denied. A great free resource that will not only tell you if a code is currently billable, but will also show you alternative codes to use if your code is NOT billable, is icd10data.com.

CPT codes, current procedural terminology, are service codes that describe the procedure performed. This procedure can be an evaluation, a re-evaluation, or a treatment. Insurance companies identify the services that you provide from this code, and they require that providers document medical necessity for the provided services. If an insurance company ever questions your treatment of a client, you must be able to provide documentation that supports your treatment plan as medically necessary.

To learn more about the basics of insurance billing for occupational therapists, download our free ebook today.

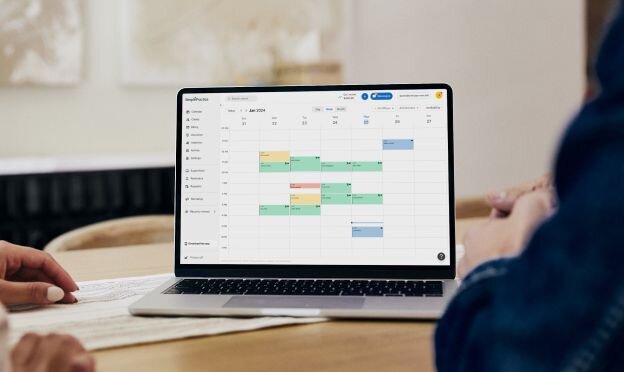

Practice management software for occupational therapists

Start and grow your occupational therapy practice with SimplePractice—an easy-to-use, fully integrated EHR solution trusted by more than 200,000 practitioners nationwide.

- Effectively manage scheduling, billing, documentation, and more

- Stay secure with a HIPAA-compliant solution you can trust

- Take your practice on-the-go with a convenient mobile app that lets you effectively treat clients during home visits, community visits, or virtually.

Try SimplePractice free for 30 days. No credit card needed.